Introduction to Brians Club Credit Score

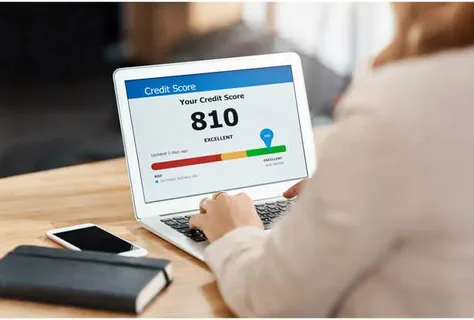

In today’s fast-paced financial world, securing your future isn’t just about earning a paycheck. It’s about building long-term wealth and ensuring that you have the tools to sustain it. Enter Brians Club Credit Score—a powerful ally in your journey toward financial security. Whether you’re aiming for homeownership, planning for retirement, or simply looking to maintain peace of mind, understanding the significance of a good credit score is crucial.

Briansclub.bz offers unique insights into how credit works and why it matters more than ever. With the right knowledge and strategies at your fingertips, you’ll be well-equipped to navigate life’s financial hurdles with confidence.

Let’s dive deeper into what makes Brians Club an essential resource on your path to lasting wealth and stability!

The Importance of a Brians Club Good Credit Score for Long-Term Wealth

A good credit score from Brians Club can be a game changer for your financial future. It opens doors to better loan rates, which translates into substantial savings over time. With lower interest rates, the cost of borrowing decreases significantly.

Having a solid credit score also enhances your chances of securing favorable mortgage terms. This is essential if you’re looking to invest in real estate—an integral part of building long-term wealth.

Additionally, a strong credit profile boosts your credibility with lenders and financial institutions. They see you as someone who manages their finances responsibly, making it easier to access lines of credit when needed.

Beyond loans and mortgages, a high Brians Club score can positively affect insurance premiums and even job opportunities in certain fields. It’s not just about borrowing; it’s about creating an advantageous position for all aspects of life that require trustworthiness in managing money.

How Brians Club Credit Score Works

Brians Club Credit Score operates on a unique algorithm designed to assess your financial behavior. It considers various factors, including payment history, credit utilization, and account types.

When you use Brians Club services, each transaction contributes to your score. Making timely payments boosts your rating while missed ones can drag it down significantly.

Your credit limit and the frequency of usage also play crucial roles. Lowering high balances shows responsibility and positively impacts your overall score.

Additionally, Brians Club offers insights into what influences your score the most. This feature helps users understand how their actions align with maintaining good standing.

With regular updates reflecting changes in financial habits, users are always informed about their current standing. This transparency fosters better decision-making for long-term wealth growth.

Features and Benefits of Brians Club Credit Score

Brians Club Credit Score offers a range of features designed to empower users financially. One standout feature is its real-time monitoring, keeping you updated on any changes that could impact your score.

Another key benefit is personalized insights tailored to individual financial behaviors. This helps users understand their credit habits better and adjust accordingly.

Additionally, Brians Club provides educational resources that demystify credit scoring. Users can easily access tips and best practices for improving their scores over time.

The platform also supports seamless integration with various financial tools. This ensures users have all the information they need in one convenient location.

With these features, Brians Club not only enhances your understanding of credit but actively aids in building strong financial foundations for the future.

Real-Life Success Stories: How Brians Club Credit Score Helped People Achieve Long-Term Wealth

Many individuals have turned their financial lives around thanks to Brians Club.

Take Sarah, for instance. After struggling with debt, she decided to focus on her Brians Club Credit Score. By diligently paying bills and keeping her credit utilization low, she increased her score significantly. This improvement opened doors for lower interest rates on loans, allowing her to buy a home sooner than expected.

Then there’s Mark, who used his strong Brians Club Credit Score to secure funding for his startup. Investors were impressed by his financial responsibility and saw him as a lower-risk candidate. With the additional capital, he launched a successful business that now generates substantial income.

These stories highlight how leveraging a good credit score can lead to life-changing opportunities. Individuals invest in their futures through smart financial decisions backed by reliable tools like Brians Club.

Tips for Maintaining a Good Credit Score with Brians Club

Maintaining a solid credit score with BriansClub is crucial for your financial health. Start by paying your bills on time every month. Timely payments show lenders you’re responsible.

Keep an eye on your credit utilization ratio, ideally below 30%. This means using only a portion of your available credit. It reflects good management and boosts your score.

Regularly check your credit report for errors or discrepancies. If you find any inaccuracies, dispute them quickly to ensure they don’t affect your score negatively.

Diversifying your types of credit can also help. A mix of loans and revolving credits shows that you can handle different forms responsibly.

Avoid opening too many new accounts at once. Each inquiry about new credit can lower your score slightly but adds up over time if you’re not careful. Small steps lead to significant improvements in the long run when handled wisely with Brians Club.

Conclusion: Investing in Your Financial Future with Brians Club Credit Score

Investing in your financial future starts with understanding the tools available to you. The Brians Club Credit Score is not just another number; it’s a means of establishing trust and credibility in your financial life. A good credit score opens doors to favorable loan terms, lower interest rates, and can even impact job opportunities.

By leveraging the features and benefits of Brians Club’s system, individuals can build a strong financial foundation that supports long-term wealth. Real-life success stories illustrate how others have transformed their lives by prioritizing their credit scores through this platform.

Maintaining a healthy credit score requires diligence but pays off significantly over time. With the right strategies in place, anyone can harness the power of Brians Club Credit Score for greater financial security. It’s about making informed decisions today for a prosperous tomorrow—one step at a time toward achieving your wealth goals.